tax avoidance vs tax evasion uk

Of this 15bn an estimated 7 billion a year due to evasion. What is tax avoidance and what is tax evasion.

Differences Between Tax Evasion Tax Avoidance And Tax Planning

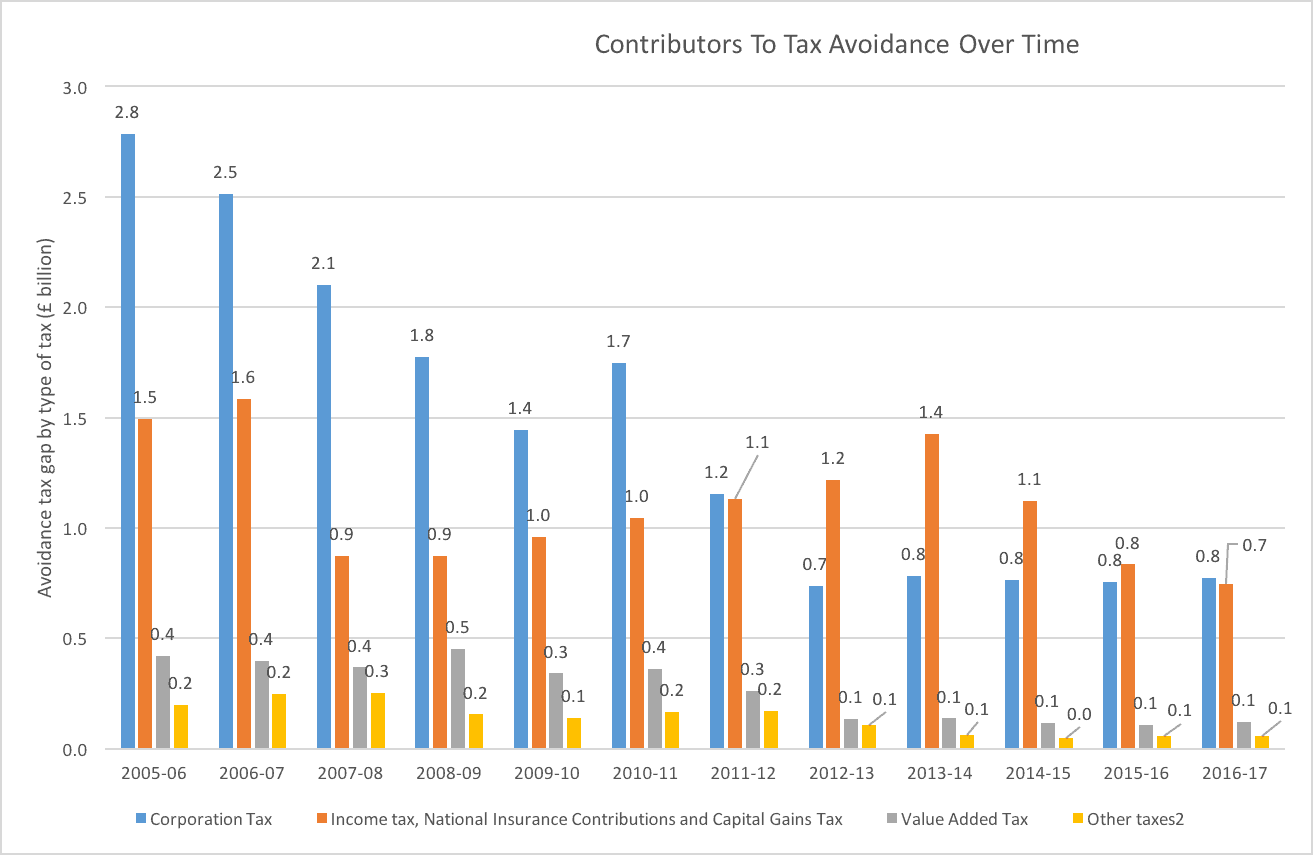

2 The tax gap 3 The Coalition Governments approach.

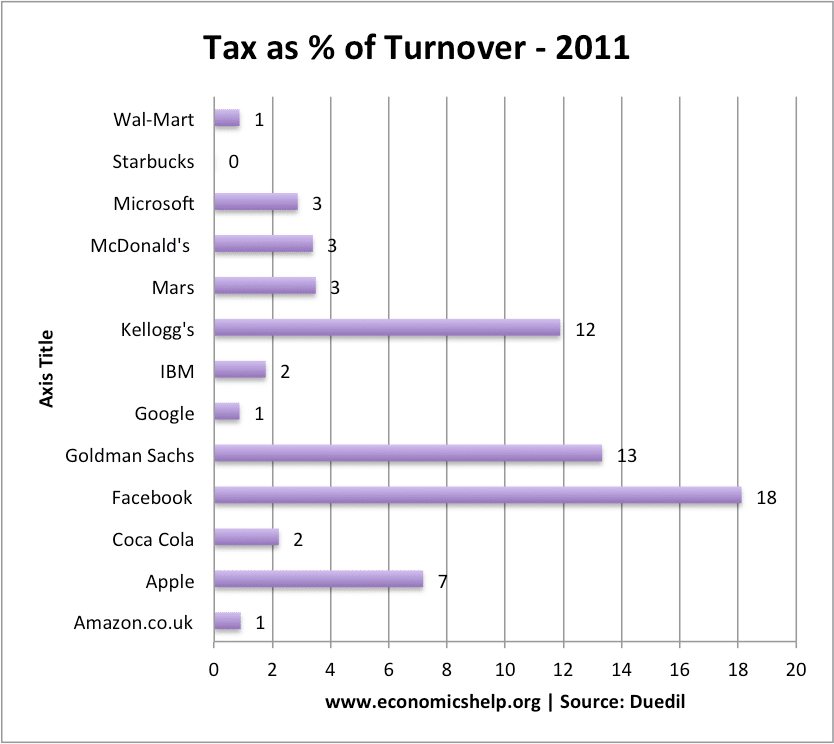

. But some businesses and individuals go much further to minimise their tax liabilities which can give rise to accusations of tax avoidance if not blatant tax evasion. According to most recent. Its as simple as that.

Tax evasion on the other hand is using illegal means to avoid paying taxes. Tax avoidance is structuring your affairs so that you pay the least amount of tax. It always creates a lot of anger and questions about how to get away with.

Tax avoidance and tax evasion Summary 1 Introduction. It even makes big news for celebrities and large multinationals. This is much easier to define as to have.

Fraudsters who carried out a 100 million tax avoidance fraud have been sentenced to 27 years in prison. The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk. Usually tax evasion involves hiding or misrepresenting income.

Tax evasion is when individuals or businesses deliberately decide to commit a crime and allow illegal actions to take place to avoid paying tax. In addition Annex A lists details of over 100 measures the government has introduced since 2010 to crack down on avoidance evasion and non-compliance and Annex B. In the UK income tax evasion may result in a maximum penalty of seven years in jail.

In the uk income tax evasion may result in a maximum penalty of seven years in jail or an unlimited fine. The difference between tax evasion and tax avoidance largely boils down to two elements. The tax evasion vs tax avoidance debate is a long-standing one.

It is the illegal practice. Any attempt to evade or defeat a tax is punishable by up to 250000 in fines 500000 for corporations five years in prison or a combination of the. Tax evasion is ILLEGAL.

In the uk income tax evasion may result in a maximum penalty of seven years in jail or an unlimited fine. As such tax evasion comes with a heftier penalty than. In this respect tax evasion may be more of the low-hanging fruit given its frequency and many different forms.

Tax avoidance has always created interesting news. Tax evasion is a felony. HMRCs work on the tax gap.

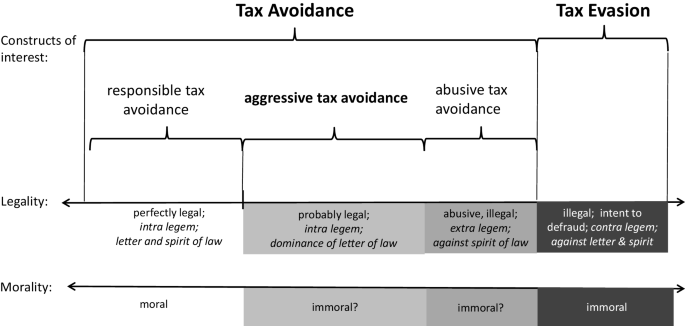

Whether its famous musicians footballers or global businesses in recent years HMRC have made it a priority to clamp down. Tax avoidance may exist in a controversial area of the tax system but tax evasion most definitely doesnt. The difference between tax avoidance and tax evasion is that tax avoidance schemes operate within the law but are described by HMRC as not being in the spirit of the.

New Course Release Tax Evasion Failure To Prevent Vinciworks Blog

2019 Uk Tax Avoidance Statistics Tax Avoidance Schemes

Avoiding Tax May Be Legal But Can It Ever Be Ethical Guardian Sustainable Business The Guardian

Tax Evasion Vs Benefit Fraud R Ukpolitics

7 Corporate Giants Accused Of Evading Billions In Taxes Fortune

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Concept Of Tax Evasion Tax Avoidance Definition And Differences

Cost Of Tax Avoidance Evasion In Uk Economics Help

Understanding Tax Evasion And Avoidance I Hate Numbers

Pdf Tax Evasion Tax Avoidance And Tax Expenditures In Developing Countries A Review Of The Literature Semantic Scholar

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Evasion And Tax Avoidance Definitions Differences Nerdwallet

Tax Dodging And Benefit Grabbing The Scale Of The Problems Full Fact

Tax Evasion Vs Tax Avoidance Tax Consultant In Uk

Tax Avoidance Vs Tax Evasion What S The Difference Informi

Tax Avoidance Vs Tax Evasion 1958 Edition Open Library

Aggressive Tax Avoidance By Managers Of Multinational Companies As A Violation Of Their Moral Duty To Obey The Law A Kantian Rationale Springerlink